Linux has emerged as a mainstream embedded technology. Once used mostly within smaller projects and research labs, Linux is now embraced as a key technology platform by large companies such as Sony, Motorola, Phillips, Panasonic, Siemens, and others. This trend has had an impact on embedded solutions vendors, and most have established strategies going forward either for supporting the development of Linux-based devices or countering the emerging Linux threat.

The Linux operating system is not uniquely designed with the requirements of the embedded developer in mind. The core focus of Linux has been on the server and desktop markets, and therefore its use in the embedded market has taken longer to become established. In addition to its substantial code size, Linux is not innately well equipped to manage system resources or handle strict real-time requirements as efficiently as smaller, more nimble embedded and real-time operating systems.

Yet, despite its inherent shortcomings within embedded environments, the Linux platform continues to steadily drive its way into the embedded market. Linux is gaining share within a wide number of embedded industry segments, as previous barriers to entry (such as the cost of processing power) diminish. The fact that companies continue to pursue the use of Linux in the embedded market in spite of its deficiencies speaks to the many advantages that the technology itself – as well as the open source model – can bring to embedded systems development.

In addition to Linux providing a transparent operating system environment, Linux developers can make use of a wide range of publicly existing device drivers, design systems using the latest communication protocols, more easily build robust graphical interfaces, supplement existing platforms with technology leveraged from the enterprise Linux domain, and enjoy royalty-free production licensing. As embedded developers continue to look to incorporate more functionality into new and existing designs at a lower cost, Linux can offer a proven, royalty free, open source alternative to proprietary operating system platforms.

Thursday, December 29, 2005

Final Embedded Linux Highlights

Wednesday, December 28, 2005

Software Problems Shake Up Guidant/J&J Merger

How expensive is embedded software? At one point, software bugs were going to cost Guidant $6.4 Billion (sic). There were some manufacturing problems as well, so it was not just software. But software problems were a major contributor to the company's decline in value and subsequently the lower value of J&J's acquisition offer. Now Boston Scientific is offering $25 Billion so the loss may only be $400 Million. Still a lot of money.

The software is question is in Guidant's implantable heart defibrillator product. Apparently the problem is that the devices stop working. Sounds pretty serious. Amazingly, the company did not warn doctors about the problem right away. The FDA does not like that.

We write a great deal about the importance of embedded software on device performance and company performance as well. Unfortunately it takes a major event for folks in the upper ranges of management to see light as well. Bet that $6.4 Billion woke them up.

Tuesday, December 27, 2005

More Embedded Linux Market Highlights

VDC expects that the sale of commercial products and services in the embedded market will continue to experience strong growth across the major geographic regions. The Americas region is expected to be the largest market for commercial Linux software in 2005. The EMEA region will be the fastest-growing market for embedded Linux solution through 2007.

Linux continues to receive broad acceptance within a growing number of embedded verticals. The platform’s flexibility and the demand for increased connectivity and functionality continue to drive developers to the operating system. The consumer electronics, telecom/datacom, military/aerospace, and industrial automation industries were significant markets for embedded Linux solutions.

MontaVista was the leading vendor of Linux-based embedded solutions in 2004. However, Wind River System’s entrance into the Linux market will considerably impact the competitive landscape, as VDC expects explosive Linux growth from the company in 2005.

In addition to competing against rival commercial Linux vendors, market participants also face threats from the open source community, semiconductor vendors, board vendors, and other competitive operating system vendors, including Microsoft and others.

Embedded Linux Market Highlights

VDC recently published its annual report on embedded Linux. Here are some of the report highlights.

VDC recently published its annual report on embedded Linux. Here are some of the report highlights.

Driving the market for commercial Linux-based software solutions are the following factors:

– Developer demand for open source software and source code access/control

– Continued demand for run-time royalty-free software

– Drive to build devices with advanced network connectivity, sophisticated user interfaces, and enhanced functionality

– Availability of Linux device drivers, communication protocol stacks, and other technologies from the greater Linux ecosystem

– Entry of Wind River Systems into the Linux market

– Growing number of commercial embedded vendors offering solutions that support Linux-based development

– Increasing availability of development tools targeted at Linux platforms

– Semiconductor and hardware supplier’s continued support for high-quality open source solutions that can be bundled with products and decrease customers’ overall software spend

– Growing population of experienced Linux programmers

– Strong growth of key embedded device markets including consumer electronics and telecom/datacom

– Increased use of Linux in automotive, military/aerospace, industrial, medical, retail, and office automation applications

New Analyst Coverage on WIND

Two equity analysts have initiated coverage on WIND recently.

WR Hambrecht + Co started its coverage of WIND with...Hold. The price target was $15. WIND traded at $15 this morning. Not sure WR Hambrecht + Co is going out on a limb here.

Soleil began covering WIND with a Buy. They are expecting WIND to go all the way to $17. That does not seem like much upside.

Back on 12.7 Citigroup opened with a hold.

Thursday, December 22, 2005

VDC Quoted Over at DSO.com

Here is the article on Toyota's software problems.

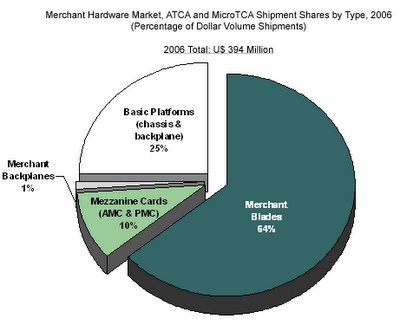

AdvancedTCA Market Penetration and Expectations

Venture Development Corporation’s newly published study of the market for AdvancedTCA and MicroTCA equipment, entitled Advanced Telecom Computing Architecture (ATCA) and MicroTCA Components and Solutions, indicates that, in 2006, shipments of merchant Blades and Mezzanine Cards for use in ATCA or MicroTCA environments will comprise US$ 291.3 million. This represents 74% of the total ATCA board-and-chassis level merchant hardware market, as shown in the Exhibit below.

At the AdvancedTCA Summit, held in early December in San Jose, some vendors and developers expressed some dismay that this architecture had not achieved greater penetration, and expressed some doubts as to its viability or acceptance by the market, given the “somewhat lackluster” shipments achieved in 2005 and projected for 2006. VDC’s Eric Gulliksen and PICMG’s Joe Pavlat pointed out that this performance was by no means lackluster and, in fact, substantially exceeded the penetration achieved by previous standards-based architectures in the early stages of the life cycle.

The AdvancedTCA base specification, PICMG 3.0, was only released in 2002, and extensions defining the Backplane Link Technologies (switch fabrics) were not released until 2003. Thus, in 2006, the beginnings of a viable AdvancedTCA ecosystem will have been in place for barely three years. It took roughly ten years for VME to become established, and five or more years for CompactPCI.

Are the total expected year 2006 shipments of US$ 291.3 million significant enough to indicate that the architecture has become accepted and established, or does this truly represent “lackluster” performance?

VDC’s most recent study of the overall market for merchant computer boards, The Merchant Computer Boards for Embedded/Real-Time Applications Intelligence Program, published in April of 2005, projects the total value of the global merchant embedded board market, including all standards-based board types and architectures, to be US$ 4,178 million in 2006. The projected 2006 AdvancedTCA shipments are just under 7% of this total market.

AdvancedTCA (and MicroTCA) comprise passive backplane architectures. The aforementioned merchant board study projects total global shipments of slot cards and mezzanine cards for use in passive backplane systems to be US$ 3,188 million; projected AdvancedTCA shipments comprise more than 9% of this total. This is by no means lackluster performance for an emerging architecture and ecosystem.

The apparent disconnect arises from unrealistic expectations caused by industry and media hype. The trumpeting headlines have led some to believe that AdvancedTCA would “take over the world” almost overnight. This cannot and will not happen. Penetration will be evolutionary and gradual, not abrupt. Indeed, despite industry hype, both VDC‘s research and that conducted by certain other organizations have indicated that many carriers are still not aware of ATCA and its value proposition and, among those that are aware, many are still less than convinced.

Nevertheless, VDC expects continued growth of AdvancedTCA and its sibling MicroTCA such that ATCA Blades and AMC/PMC Mezzanine Cards for use in ATCA/MicroTCA environments will comprise US$ 1,918 million in shipments in 2009; this will be roughly equivalent to 34% of the total standards-based merchant embedded board market, or 45% of the slot & mezzanine card market. Lackluster performance? We don’t think so!

Wednesday, December 21, 2005

Oracle Addresses Multi-core Licensing

Oracle has announced a new licensing scheme to address the move to multi-core computing in the enterprise. Perhaps there is something to learn here for vendors of embedded systems components. Under the new model, Oracle will still charge for each core that its software runs on. However, there will be discounting for computers/servers running multiple cores. In an article in the Financial Times today, the example provided is Sun's new 8-core processor on which the discount would be 75% or the equivalent of 2 full Oracle licenses for the chip.

Embedded Systems vendors are starting to run into similar situations. For vendors using run-time or production licensing this can pose a challenge. Of course, vendors offering royalty licensing should be aggressively pursing multi-core projects where they will likely have an advantage in cost. As multi-core becomes more commonplace and perhaps the rule rather than the exception, vendors will need to consider alternative licensing models or aggressive discounting to remain competitive.

Tuesday, December 20, 2005

More on engineering education...

These charts come from VDC's database of embedded developers. The survey took place in the Spring of 2005. From this data the education gap looks much closer than one might expect given the study we wrote about yesterday. Of course, this is one survey of embedded software developers and not engineers of all types.

IAR signs million dollar contract

Sweden-based IAR has signed a contract with a major semiconductor manufacturer. From the looks of the press release the contract has some NRE, as well as tools licenses for the semiconductor manufacturer. In 2006, IAR will offer a new product in its Embedded Workbench line as part of the agreement.

IAR Systems AB was acquired by Nocom AB in Q1 2005 and has since been delisted from the Stockholm Stock Exchange O-list. IAR has been struggling for some time now, but its tools have always been very highly rated in VDC surveys. Perhaps this contract will be part of the turn around.

Speaking of engineering education...

Check out the article on page B1 of today's Wall Street Journal. It profiles Olin College here in Massachusetts. Olin will graduate its first class this academic year.

Monday, December 19, 2005

Is the US competitive in engineering? Maybe, Maybe Not.

A new study out of Duke Univ. suggests the US is more competitive with India and China than we thought, at least in terms of engineering education. We are not sure the whole answer to the issue is provided by the study. VDC still believes the future is in question and that little is being done to alter the course of our engineering education system and our future competitiveness. We know it is a global economy and we are free marketers. However, we do not live in Global, we live in the US. The future here matters to us.

Aonix ObjectAda Now Available for VxWorks/PowerPC

Aonix ObjectAda for Windows now supports Wind River’s Tornado 2.x and VxWorks 5.x environments.

Looks like a strong indication that there is a substantial installed base of Wind River legacy product in the Mil/Aero market. VDC believes that customers in the Mil/Aero market are moving to the 6.0 release, but it looks like a number of OEMs are sticking with the older platform. Witness the strength in Q3 FY06 in WIND's Aerospace and Defense business. The legacy product could be on long-term contracts/projects.

VxWorks 6.0 support is expected in early 2006.

The main points are summarized below:

- ObjectAda for Windows 8.2 includes the comprehensive Ada libraries needed for calling Windows Win32 and the Visual C++ .NE 2003 MFC interfaces from application source code written in Ada.

- ObjectAda 8.2 Windows cross PowerPC/VxWorks is available under the CorePack packaging that includes an Ada 95 compiler, Ada 95 optimizer, partial annex C support, partial annex D support, syntactic editor, graphical and command line interfaces, library configuration tool, program builder, source browsing engine, source registration tool, source un-registration tool, source code reference tool, symbolic debugger, and graphical installer.

- ObjectAda Windows cross PowerPC/VxWorks starts at $15,000

- Available immediately for Windows 2000 and XP host platforms

Friday, December 16, 2005

Can the DD(X) deliver on its mission?

Bob Novak wrote a piece on the battle between battleships and the DD(X) program. Many embedded vendors have a stake in the DD(X) so this is worth writting about. The DD(X) is also one of the platforms for evaluating embedded real time Java. There is a lot of food for thought here. A couple of items caught VDC's eye:

On the modernized battleships, 18 big (16-inch) guns could fire 460 projectiles in nine minutes and take out hardened targets in North Korea. In contrast, the DD(X) will fire only 70 long-range attack projectiles at $1 million a minute. The new destroyer will rely on conventional 155-millimeter rounds that Marines say cannot reach the shore. Former longtime National Security Council staffer William L. Stearman, now executive director of the U.S. Naval Fire Support Association, told me, "In short, this enormously expensive ship cannot fulfill its primary mission: provide naval surface fire support for the Marine Corps." (VDC added the emphasis)

and

Never has it been clearer how the military-industrial complex functions. Lockheed Martin, Northrop Grumman, Raytheon, General Dynamics and BAE Systems are mobilized behind DD(X). Congressional staffers, eyeing a future in the Pentagon or the armaments industry, know the way to future advancement is not to be pro-battleship.

There seems to be similar concerns about aspects of the Future Combat System as well.

Paravirtual Reemerges

VDC spoke with Ross Wheeler from Paravirtual this morning. The company, formerly Accenia, has reemgered as a player in the virtual platforms sector of the market. Like other players in virtual software platforms (Virtio, Vast, Virtutech, etc.) they are trying to solve the problem of developing software without having physical reference hardware available. Paravirtual is positioned to address development on top of the OS, as well as on peripheral chips. The company supports VxWorks, Nucleus, ThreadX and Linux.

Welcome Back.

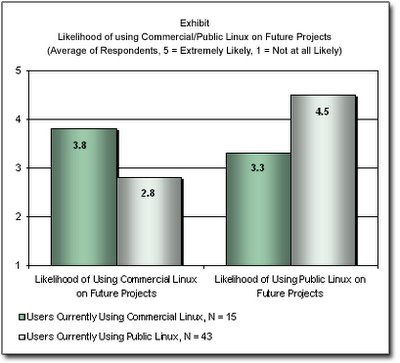

Are companies using commercial Linux considering migrating to non-commercial Linux distributions?

Vendors of commercial Linux distributions face many challenges as the Linux market continues to evolve. One of the most challenging issues will be their ability to compete with the open source community and provide value above what is already available from public sources.

While many customers will continue to look to a commercial supplier to support the ongoing development of their Linux kernel, there exists the potential for many to opt to bring this development in-house as internal developers gain more experience with maintaining the Linux kernel themselves.

VDC’s most recent end-user survey indicates that while users of publicly sourced Linux distributions are highly likely to use non-commercial Linux in the future, commercial Linux users seem to have less confidence that they will use commercial suppliers on future projects.

Thursday, December 15, 2005

Enea CEO wants to get the heads of the five DSO families together

(And anyone else with an interst in DSO)

In an article over on DSO.com Enea CEO Johan Wall is sounding the call for a DSO Summit to get the heads of the five DSO families together (as well as other vendors who are interested) to discuss how to take the idea to the next level. Currently, the DSO converts are Wind River, Green Hills, Enea, Intel, and IBM at least by my count. But I bet a number of other companies would be willing to jump on board if a stable and credible organization could be formed. After all it ends up being very cost effective marketing. Wall likens the organization that might be formed to a software SEMI offering standards, shows, advocacy, education, etc.

The embedded or DSO industry is highly fragmented. Hundreds of companies offering thousands of products. Some have full product lines, some offer point solutions. There are dozens of applicable standards that companies are supporting. Some are major standards like POSIX, or DO-178B, OSEK, CGL, etc. while others are niche standards like the emerging LiPS and OSDL standards for Linux on mobile phones.

There have been attempts to create an embedded software industry group. All have failed. In many ways the eclipse foundation has emerged as an industry organization even though embedded or device software is only part of its mission. Eclipse is broadly supported by vendors in the embedded systems market and many of the key vendors have embraced the IDE including Wind River, MontaVista, QNX, etc. But eclipse, is in reality, too narrowly focused on tools. The scope needs to be larger and more inclusive.

Establishing a DSO industry organization is a good goal to have. Hopefully, it will bring some focus to the fragmentation that plagues this sector. Vendors in this market have as much in common as they have in competition. It will help raise the visibility of software to its proper level of importance in the OEM community. Despite the skyrocketing cost of code and its position as the key driver of new features, software remains largely invisible in the product development process. However, getting all of the players to sit down at a single table will be tough. The most recent sign is the blow up between Wind River and Green Hills over DSO. But perhaps the pull of common interest will be stronger than the pull of competition.

And the Eclipse Community Award Goes To

Get you nominations together for the Eclipse Community Awards .

They will be presented at EclipseCon in the Spring.

Deadline is January 27, 2006

Wednesday, December 14, 2005

Great Article on Build vs. Buy

Jack Ganssle has a great column on embedded.com on build vs. buy decision making. Some of these decisions seem so easy to make and yet time and time again engineering managers opt to invest many times the cost of a commercial product, in engineering expense, to go the build route.

There are hundreds of RTOSs in the market with just about as many price points and business models. There must an operating system for every possible project that can be quickly and economically purchased and yet in the end many managers have a hard time parting with cash. It seems that we undervalue engineering time, while at the same we discount the utility of cash. We forget that it is just one more tool in our toolbox. It's changing, but not fast enough.

I-Logix and McObject Forge Partnership

I-Logix, the UML tool vendor has been building deep relationships with some of its partners. Earlier this fall VDC covered their new partnership with Green Hills Software. See the coverage here.

Now I-Logix has introduced awareness of McObject's eXtremeDB into Rhapsody. Here is the beginning of the release:

Object Integrates eXtremeDB with I-Logix’s Rhapsody UML-Based Model-Driven Development Environment

Issaquah, WA - December 12, 2005

McObject, developer of the eXtremeDB in-memory embedded database, announced it has integrated eXtremeDB with I-Logix’s Rhapsody, a Unified Modeling Language (UML™)-based, award winning, Model-Driven Development (MDD) environment. The coupling of eXtremeDB and Rhapsody enables faster time-to-market of high quality embedded applications that require embedded data management. For the rest.

Wind River Regional Developer Conference

VDC attended the Wind River Regional Developer Conference in Westford, MA this morning. The conference was well attended with about 150 developers packing the presentation room. John Fanelli, VP of Product Planning and Management at Wind River was the primary host of this stop. Next to the presentation room was a partner pavilion or in Wind parlance "Smart Bar" with many key WIND partners including I-Logix, Express Logic, Encirq, IBM, Coverity, Skelmir, Virtutech and many others.

The demos during the presentations were very strong and well executed. The best one VDC saw was on Workbench Diagnostics a tool that permits dynamic root cause analysis of software bugs. If you can catch a WR RDC near you this demo should not be missed. You need to see it to get the full impact. The next RDC is in Chicago tomorrow.

For more information: http://www.windriver-rdc.tpgnc.com/

Tuesday, December 13, 2005

db4objects Update

db4objects, the commercial company supporting the db4o open source database, recently announced new extensions to the core object database. While VDC does not typically cover new product announcements, there are a couple of interesting points emerging here. db4obejcts is to db4o as Sleepycat is to BerkeleyDB - a company that provides a commercial-grade version of an open source database. What makes db4o somewhat unique is that it is an object database originally targeting client/embedded devices. The original db4o database was well designed for its original purposes: small footprint, very fast, support for .NET and Java. However, as developers started working with the database in actual devices, they found that they needed additional features, including a query language. To meet this need:

Native Queries will provide db4o with a query language that leverages the native OO programming language (Java/C#/.Net) that the developer is already using. Native Queries, based on the Safe Queries work by Prof. William Cook, is 100% OO because they come straight from the OO language already being used. The concept is similar to Microsoft’s DLINQ concept that will be in .NET3 in 2007. However, Native Queries are targeted at OO databases not relational ones. VDC expects db4o will be 100% compatible to DLINQ, but will also provided native OO support through native queries.

William Cook and db4objects chief software architect Carl Rosenberger have written a joint white paper: www.db4o.com/about/productinformation/whitepapers/#nq

Does the Entire Embedded Software Development Process Have its Priorities Backwards: Introducing Data-Centric Development (DCD)

Does the Entire Embedded Software Development Process Have its Priorities Backwards: Introducing Data-Centric Development (DCD)

The time is coming when every time you hear “Data-Centric Development” you may think of Encirq. DCD is a design approach that makes data management - including definitions, structures, relations and manipulators - the focus of the process. Encirq believes that while C and other procedural languages are great for building functions that drive-event driven systems, they are less efficient at managing data. Why is this important? How much data management do typical embedded systems carry out? According to several case studies that VDC has seen where developers classify their lines of code by functionality, over 50% of application code is associated with data management. In some applications it can be 70%.

Encirq’s answer is to leverage Oracle’s PL/SQL, a high-level language that more succinctly manipulates and manages data than current procedural languages. ANSI C can be generated from the PL/SQL and then compiled with other application code. The result should be:

· Faster development time – PL/SQL requires many fewer lines of code

· Smaller code size – PL/SQL is more efficient per line of code for managing data

· More portable code – The data management layer is abstractive from the system

· Higher quality – Fewer opportunities to make mistakes

The problem, of course, is that developers are typically not trained to be data centric in their process. That, coupled with a lack of players in the embedded market, puts the evangelism mantel squarely on Encirq. As part of that evangelism, the company published an article in the November Embedded Systems Design (formerly Embedded Systems Programming)

Green Hills Embedded Software Summit Review

What Happened

Last week VDC visited the Green Hills Embedded Software Summit 2005 (we are calling it “GHESS”) in sunny Santa Barbara, CA. This was the third GHESS, and each one is better than the last. Green Hills continues to hone this event into a valuable day and a half of company direction, new product announcements, technology demonstrations and customer experiences. Green Hills is often knocked as being a bit too technology driven and lacking in marketing savvy. The evolution of these events shows that the company is getting better at “that vision thing.”

Speaking of vision, Green Hills has been articulating a new outlook for itself. It began with the introduction of INTEGRITY PC at last year’s GHESS, was extended last April with introduction of INTEGRITY Workstation and Server, and continues with some new product announcements in the latest edition. Couple that with a few tight presentations to bring it all together, and Green Hills has laid out a broad, clear, and comprehensive picture of the future of computing.

Core to this future is the Multiple Independent Levels of Security (MILS) architecture. MILS technology is being weaved through Green Hills’ product line including the INTEGRITY OS, its Partitioning, Journaling File System (PJFS) and the third-party middleware it will support. In this environment, a hosted OS, such as Linux or Windows, residing in an INTEGRITY partition might be a danger to itself, but not to the partitioned systems. Windows might still crash or become infected, but it won’t bring down your entire nuclear plant or Tactical Operations Center (TOC) because INTEGRITY isolates the hosted OS. In addition to security and reliability, GHS is also offering a vision of streamlining secure network computing in a number of environments (government, military) that require multiple levels of security from unclassified to top secret. For example, currently it is possible for each soldier in a TOC to have four computers each running on one of four networks: lots of machines, lots of wires. By using MILS and INTEGRITY Workstation, you could have one thin client machine running four partitioned systems. This obviously reduces the number of machines, and allows data to move from one partitioned system to another (unclassified to secret) on a single machine. Current practices included a floppy disk, sneaker net and small fire (to burn the disc). INTEGRITY acts as a security monitor and prevents data moving from a more secure to less secure network, all the time logging transactions for later review.

Green Hills announced a file system that can provide secure partitions for hard drives or flash memory – again potentially reducing the amount of hardware required to support multiple secure systems. Toss in secure middleware from a company like Objective Interface and you can simplify the network architecture. To be sure, other RTOS vendors are pursuing MILS including Wind River Systems and Lynuxworks, but Green Hills has been the most vocal and articulate about its “vision,” direction and successes in implementation.

VDC’s VIEW

So where is Green Hills going with all this? Well, the tag line of the GHESS 2005 was “INTEGRITY: The first universal operating system.” VDC would like to take this a step further in terms of detail and clarity and offer that Green Hills has a place in any system that requires reliability and security. This by the way includes essentially all systems from handsets to servers from telematics to workstations. In this future of computing, Green Hills’ INTEGRITY is wrapped around Windows, Linux, and perhaps other OSs to provide a partitioned and protected operating space.

Forget embedded. After all, what is “embedded?” At VDC, we have been talking for some time about a market definition driven not by arbitrary applications (as Marcus Levy asked us: “is this TREO an embedded device?”) to one derived from requirements (like reliability, security, perhaps safety.) Green Hills, perhaps without saying it, is actually heading down this road. The form factor of the device is not the key to whether or not that device is a good potential market for them, but rather what that device has to do in the real world. Look to performance requirements, not physical characteristics.

The old definition of “embedded” looks like this: “headless, resource constrained (processing power, memory), real-time requirements, contained inside another computer…” This definition is meaningless today with the variety of devices and sheer power of the components used to build them.

Vendors, including Green Hills must begin to position themselves as providers of reliable and secure software for whatever platform. To become suppliers of “Trusted” software, not embedded software. All of the reliability and security capabilities of software in the traditional “embedded” market are just as valuable or perhaps even more valuable to “enterprise” systems. How many viruses, worms or Trojans have infected or attempted to infect your work or personal computers this week?

Of course, managing this transition from a sub-$100 million embedded company to a major IT player spanning all sorts of markets is the tough part. Certainly Green Hills does not want to give up the core markets that have made it the fastest-growing embedded systems player. At the same time, the opportunities in the enterprise market far outweigh those available in the traditional embedded market. Green Hills is likely considering how to:

· Build a trusted supply chain – including hardware vendors and integrators who can ensure secure delivery and ongoing support of these systems.

· Build a tight “out of the box” experience – the IT teams at the NSA, Farmers Insurance or JP Morgan do not want to call GHS or its SIs every time a problem occurs.

· Deliver MILS as a solution set rather than a basket of products-including tight integration with third-party products including middleware. This is not the kind of technology that users are going to want to cobble together themselves-even if they could.

· Evangelize MILS to non-traditional secure markets like Insurance and Financial Services-clearly new territory for Green Hills.

· Remember where they came from with so much opportunity on the horizon – including a focus on core markets and products.

As for the TREO – yes, it is an embedded device and it contains at least two embedded systems. And don’t look for VDC to rename our market research service just yet – we will continue to use “embedded” for the time being. Even if we don’t think it really gets at the essence of the markets that we are studying.