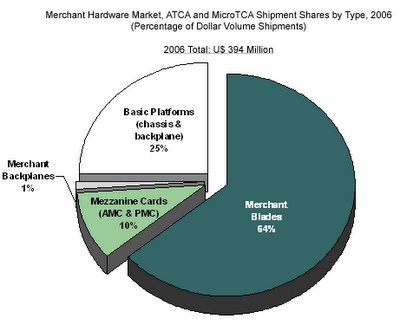

Venture Development Corporation’s newly published study of the market for AdvancedTCA and MicroTCA equipment, entitled Advanced Telecom Computing Architecture (ATCA) and MicroTCA Components and Solutions, indicates that, in 2006, shipments of merchant Blades and Mezzanine Cards for use in ATCA or MicroTCA environments will comprise US$ 291.3 million. This represents 74% of the total ATCA board-and-chassis level merchant hardware market, as shown in the Exhibit below.

At the AdvancedTCA Summit, held in early December in San Jose, some vendors and developers expressed some dismay that this architecture had not achieved greater penetration, and expressed some doubts as to its viability or acceptance by the market, given the “somewhat lackluster” shipments achieved in 2005 and projected for 2006. VDC’s Eric Gulliksen and PICMG’s Joe Pavlat pointed out that this performance was by no means lackluster and, in fact, substantially exceeded the penetration achieved by previous standards-based architectures in the early stages of the life cycle.

The AdvancedTCA base specification, PICMG 3.0, was only released in 2002, and extensions defining the Backplane Link Technologies (switch fabrics) were not released until 2003. Thus, in 2006, the beginnings of a viable AdvancedTCA ecosystem will have been in place for barely three years. It took roughly ten years for VME to become established, and five or more years for CompactPCI.

Are the total expected year 2006 shipments of US$ 291.3 million significant enough to indicate that the architecture has become accepted and established, or does this truly represent “lackluster” performance?

VDC’s most recent study of the overall market for merchant computer boards, The Merchant Computer Boards for Embedded/Real-Time Applications Intelligence Program, published in April of 2005, projects the total value of the global merchant embedded board market, including all standards-based board types and architectures, to be US$ 4,178 million in 2006. The projected 2006 AdvancedTCA shipments are just under 7% of this total market.

AdvancedTCA (and MicroTCA) comprise passive backplane architectures. The aforementioned merchant board study projects total global shipments of slot cards and mezzanine cards for use in passive backplane systems to be US$ 3,188 million; projected AdvancedTCA shipments comprise more than 9% of this total. This is by no means lackluster performance for an emerging architecture and ecosystem.

The apparent disconnect arises from unrealistic expectations caused by industry and media hype. The trumpeting headlines have led some to believe that AdvancedTCA would “take over the world” almost overnight. This cannot and will not happen. Penetration will be evolutionary and gradual, not abrupt. Indeed, despite industry hype, both VDC‘s research and that conducted by certain other organizations have indicated that many carriers are still not aware of ATCA and its value proposition and, among those that are aware, many are still less than convinced.

Nevertheless, VDC expects continued growth of AdvancedTCA and its sibling MicroTCA such that ATCA Blades and AMC/PMC Mezzanine Cards for use in ATCA/MicroTCA environments will comprise US$ 1,918 million in shipments in 2009; this will be roughly equivalent to 34% of the total standards-based merchant embedded board market, or 45% of the slot & mezzanine card market. Lackluster performance? We don’t think so!

Thursday, December 22, 2005

AdvancedTCA Market Penetration and Expectations

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment